Section 179 depreciation calculator

This means businesses can deduct the full cost of equipment from their 2019 taxes up to 1000000 with a total equipment. Thats where Bonus Depreciation comes in.

Section 179 Tax Deduction Leadermac Usa

The Section 179 Deduction is now 1000000 for 2019.

. Total Amount Of Deduction. For tax years beginning 2020 if a business spends more than 2590000 on property the Section 179 deduction will be reduced by that amount. Your company is allowed to deduct the full cost of equipment either new or used up to 1080000 from 2022s taxable.

The Section 179 deduction limit for 2017 is 500000. What is a Section 179 Deduction. Section 179 deduction limit is now 1080000.

Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. The total amount that can be written off in Year 2020 can not be more than 1040000. Limits of Section 179.

The Section 179 Tax Deduction is meant to encourage. 2022 deduction limits qualifying equipment updated tax deduction calculator and more all in Plain English. But while Bonus Depreciation isnt technically part of Section 179 it can often be.

This is a very healthy tax deduction and means businesses can deduct the full cost of qualifying equipment from their 2017 taxes up to. Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. It is named after the section in which the depreciation allowances are.

For qualifying property you would still deduct just 1050000. 2022 Section 179 Deduction threshold for total amount of equipment that. Ad Site is Updated Continuously.

Section 179 is a special tax provision. But while Bonus Depreciation isnt technically part of Section 179 it can often be used as Part 2 of Section 179 savings. This limit is reduced by the amount by which the cost of.

Section 179 can save your business money because it allows you to take up to a 1080000 deduction when purchasing or leasing new machinery. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. It allows businesses to deduct certain capital assets as an expense in the current year instead of multi-year depreciation.

Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Make your pharmacy more productive profitable when you use this tax benefit with Parata. Section 179 is a form of tax deduction that relates to the depreciation of assets. There is also a limit to the total amount of the equipment purchased in one year ie.

Includes Editors Notes Written by Expert Staff. 100 bonus depreciation for 2022 new and used equipment allowed. 1 in-depth understanding of the types and amounts of qualifying short-life assets 2 statistical.

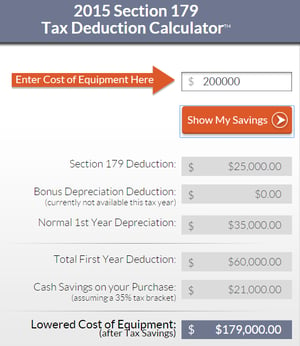

The bonus depreciation calculator is proprietary software based on three primary components. The Section 179 Deduction and Bonus Depreciation apply for both new and used equipment. These limits are adjusted.

The Section 179 deduction limit for 2022 has been raised to 1080000. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Section 179 calculator for 2022 Enter an equipment cost to see how much you might be.

Bloomberg Tax Offers Full-Text of the Current Internal Revenue Code Free of Charge. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. With a 1050000 deduction limit youll be able to deduct.

This easy to use calculator can help you. Section 179 Deduction Calculator is an excel template to help you calculate the amount you could save on your tax bill by taking the Section 179 Deduction. For 2021 Bonus Depreciation is 100.

Section 179 deduction dollar limits. Official Section 179 information for businesses.

Section 179 Depreciation Tax Deduction 2015 2019 Taycor Financial

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Section 179

Macrs Depreciation Calculator With Formula Nerd Counter

How To Take Advantage Of Office Furniture Tax Deduction Ams

February 2016 Depreciation Guru

Section 179 Tax Deduction How To Write Off Your Equipment Fieldedge

Section 179 Depreciation Tax Deduction 2015 2019 Taycor Financial

Macrs Depreciation Calculator With Formula Nerd Counter

Four Reasons Section 179 Tax Savings Still Matter In 2015

Macrs Depreciation Calculator With Formula Nerd Counter

News Axis Nj

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Section 179 Depreciation Guru

![]()

Section 179 Depreciation Tax Deduction 2015 2019 Taycor Financial

Macrs Depreciation Calculator With Formula Nerd Counter

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar